CA FTB 3582 2024-2026 free printable template

Show details

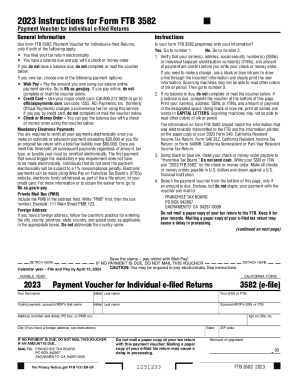

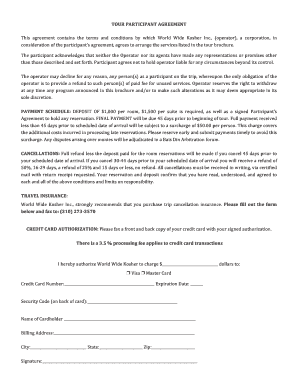

2024 Instructions for Form FTB 3582 Payment Voucher for Individual e-filed Returns General Information Use form FTB 3582 Payment Voucher for Individual e-filed Returns only if both of the following apply You filed your tax return electronically. Do not abbreviate the country name. Is your form FTB 3582 preprinted with your information Yes. Go to number 1. Write your SSN or ITIN and 2024 FTB 3582 on the check or money order. Make all checks financial institution. 4. If you cannot pay the full...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign pdffiller form

Edit your form 3582 california form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your california payment voucher form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing payment e returns online

In order to make advantage of the professional PDF editor, follow these steps below:

1

Register the account. Begin by clicking Start Free Trial and create a profile if you are a new user.

2

Prepare a file. Use the Add New button. Then upload your file to the system from your device, importing it from internal mail, the cloud, or by adding its URL.

3

Edit form 3582. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Get your file. Select the name of your file in the docs list and choose your preferred exporting method. You can download it as a PDF, save it in another format, send it by email, or transfer it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Register for an account and see for yourself!

Uncompromising security for your PDF editing and eSignature needs

Your private information is safe with pdfFiller. We employ end-to-end encryption, secure cloud storage, and advanced access control to protect your documents and maintain regulatory compliance.

CA FTB 3582 Form Versions

Version

Form Popularity

Fillable & printabley

How to fill out california payment voucher individual form

How to fill out CA FTB 3582

01

Download the CA FTB 3582 form from the California Franchise Tax Board website.

02

Enter your full name as it appears on your tax return in the designated space.

03

Provide your Social Security Number (SSN) or Individual Taxpayer Identification Number (ITIN).

04

Fill in your mailing address, including city, state, and ZIP code.

05

Indicate your filing status by checking the appropriate box (single, married, etc.).

06

Report your California AGI (Adjusted Gross Income) as requested in the form.

07

If applicable, enter the total amounts of your credits or deductions.

08

Review the form for any additional information that may need to be included, such as previous year’s information.

09

Sign and date the form before submitting it.

10

Mail the completed form to the address specified in the instructions.

Who needs CA FTB 3582?

01

Individuals or businesses who have previously filed a California tax return and need to amend it.

02

Taxpayers claiming a refund or additional credit after filing their original return.

03

Residents who need to report changes in their tax situation since their last submission.

Fill

ca ftb voucher

: Try Risk Free

People Also Ask about ca 3582 voucher

Is there a payment voucher for 540?

Use Form 540-V, Payment Voucher for 540 Returns, only if both of the following apply: You will file a computer-generated Form 540, California Resident Income Tax Return. You have a balance due. If you do not have a balance due, do not complete or mail this voucher.

What is CA 3893?

Use form FTB 3893 to pay an elective tax for taxable years beginning on or after January 1, 2022, and before January 1, 2026.

Do you have to pay the $800 California Corp fee the first year?

California law generally imposes a minimum franchise tax of $800 on every corporation incorporated, qualified to transact business, or doing business in California. A corporation that incorporates or qualifies to do business in California is exempt from paying the minimum franchise tax in its first taxable year.

What is a payment voucher for taxes?

Form 1040-V: Payment Voucher is a statement that taxpayers send to the Internal Revenue Service (IRS) along with their tax return if they choose to make a payment with a check or money order. The IRS has different filing centers where taxpayers can send their payments and 1040-V forms depending on where they live.

Is first year LLC fee waived for California?

California LLCs after Assembly Bill 85: California LLCs don't pay an $800 fee for their 1st year (if the LLC is formed after January 1st, 2021).

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Where do I find ftb 3582?

The pdfFiller premium subscription gives you access to a large library of fillable forms (over 25 million fillable templates) that you can download, fill out, print, and sign. In the library, you'll have no problem discovering state-specific ftb 3582 payment voucher and other forms. Find the template you want and tweak it with powerful editing tools.

Can I create an electronic signature for signing my state of california form 3582 in Gmail?

Use pdfFiller's Gmail add-on to upload, type, or draw a signature. Your california form ftb 3582 and other papers may be signed using pdfFiller. Register for a free account to preserve signed papers and signatures.

How do I fill out 3582 e file on an Android device?

Use the pdfFiller mobile app to complete your ca payment voucher individual on an Android device. The application makes it possible to perform all needed document management manipulations, like adding, editing, and removing text, signing, annotating, and more. All you need is your smartphone and an internet connection.

What is CA FTB 3582?

CA FTB 3582 is a tax form used by the California Franchise Tax Board to report California source income from partnerships, limited liability companies (LLCs), and S corporations.

Who is required to file CA FTB 3582?

Individuals who receive income from partnerships, LLCs, or S corporations that have California source income are required to file CA FTB 3582.

How to fill out CA FTB 3582?

To fill out CA FTB 3582, taxpayers must provide their personal information, report income details from partnerships, LLCs, or S corporations, and sign the form before submission.

What is the purpose of CA FTB 3582?

The purpose of CA FTB 3582 is to allow individuals to report their share of income, deductions, and credits from pass-through entities for California taxation purposes.

What information must be reported on CA FTB 3582?

On CA FTB 3582, individuals must report their name, Social Security number or taxpayer identification number, and details of the income, deductions, and credits from the partnership, LLC, or S corporation.

Fill out your CA FTB 3582 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

Ftb Payment Voucher is not the form you're looking for?Search for another form here.

Keywords relevant to california tax payment voucher

Related to payment voucher e file

If you believe that this page should be taken down, please follow our DMCA take down process

here

.

This form may include fields for payment information. Data entered in these fields is not covered by PCI DSS compliance.